This content was originally published by the Longmont Observer and is licensed under a Creative Commons license.

COVID-19 creates many economic stresses, but help is available

The closing of public gathering places and schools and the Governor’s Stay-at-Home order are necessary to control the spread of the novel coronavirus. Nobody doubts it. But the layoffs, furloughs, reduced hours, and new medical expenses have placed increased financial burdens on too many. Loss of housing poses an extreme danger during the pandemic. However, government on every level is stepping in proactively to ensure that people don’t become unhoused during the crisis.

If you are losing income now and have missed or expect to miss one or more rent payments, it is best to contact your landlord or property management company immediately. Offering a partial payment is often helpful. Help in negotiating with your landlord is available for Longmont residents through the City of Longmont’s Mediation Services.

Please contact Susan Spaulding at [email protected] / 303-774-4384 or Adriana Perea at [email protected] / 303-651-8721 for more information.

Many of the protections in place now ensure that you won't have to enter into negotiations while dealing with the crisis, but tenants are still advised to notify landlords of changes in their circumstances as soon as possible. Knowing what future income and short-term protections are be available to you will be helpful in negotiations with landlords. So will keeping good records of your income loss, unexpected expenses, and so on. The information below helps you know what to expect and how to take advantage of all the assistance on offer.

Federal Measures

On February 27, 2020 President Trump signed the CARES

act, the largest economic rescue package ever enacted. It includes economic

support measures for businesses and individuals, as well as special temporary

protections for renters and persons and businesses with federally subsidizes

mortgages. In some cases the rules for the law’s implementation need to be

clarified, but here is what is known now.

Owners of buildings with federally-backed mortgages are under an eviction moratorium for the next 100 days. So are federally-subsidized housing developments, such as the properties managed by the Longmont Housing Authority. Federally-backed mortgages include those with FHA, VA, USDA, HUD, Fannie Mae, and Freddie Mac guarantees. More details can be found here.

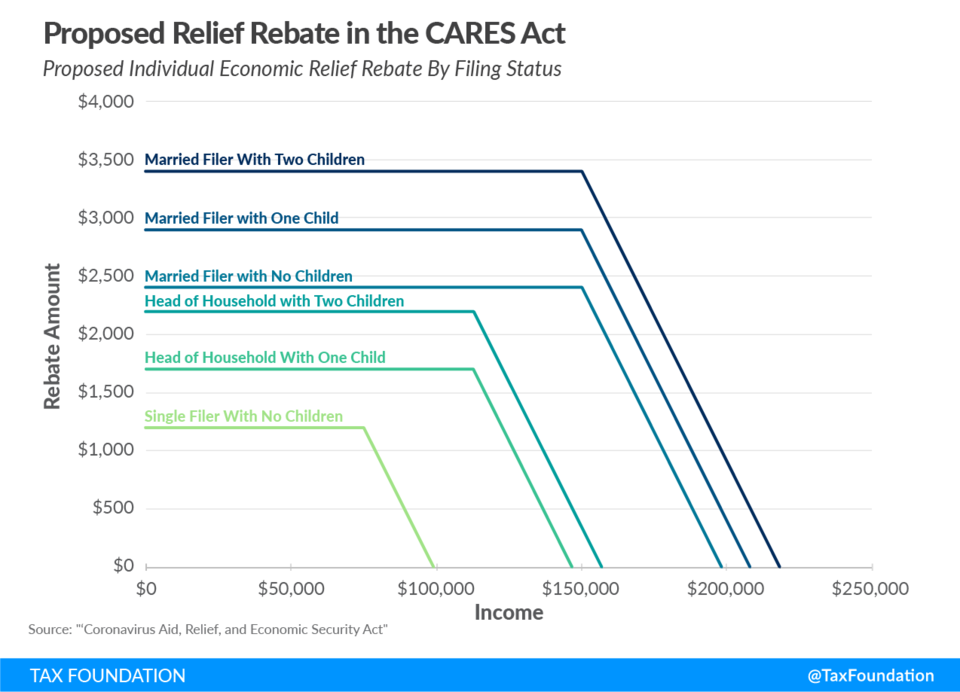

Direct financial support for individuals includes a one-time payment to almost every taxpayer called the Economic Impact Payment. It is automatic if you have already filed a 2018 or 2019 tax return. The maximum payment is $1200 per adult plus $500 per dependent child under 17. The payment for adults decreases for high-income persons or families: For singles, EIP reductions begin above $75,000/year, for heads of household, $112,500, and for couples filing jointly, $198,000. The formula is complicated, but Figure 1 shows how the phase-outs work.

If your 2018 or 2019 income was too high for you to receive a rebate in the first round of payments (expected by April 16), but you lose income in 2020, you will receive your EIP when you file your 2020 return next year.

The people who will get their EIP fastest are those who have already filed a 2018 or 2019 return and have direct deposit set up for their refund. If you filed a 2018 or -19 return but did not set up direct deposit, you may be able to do that now through your commercial tax software. If you haven’t filed for 2019 yet but plan to soon, be sure to set up direct deposit even if you don’t expect a refund.

At first, the information was given that persons on Social Security (either SSRI or SSDI) are who are not required to file a Federal Tax return would have to file a special form to get their EIP. Now that direction is being retracted. The IRS web page https://www.irs.gov/coronavirus is now advising persons not required to file to wait, but current word among human services professionals is that the IRS will send checks using the information it already has and not require any special actions. Other useful information is published on irs.gov/coronavirus, so bookmark the site and keep checking back every few days. Staying informed may help you receive your payment faster.

Unemployment Benefits

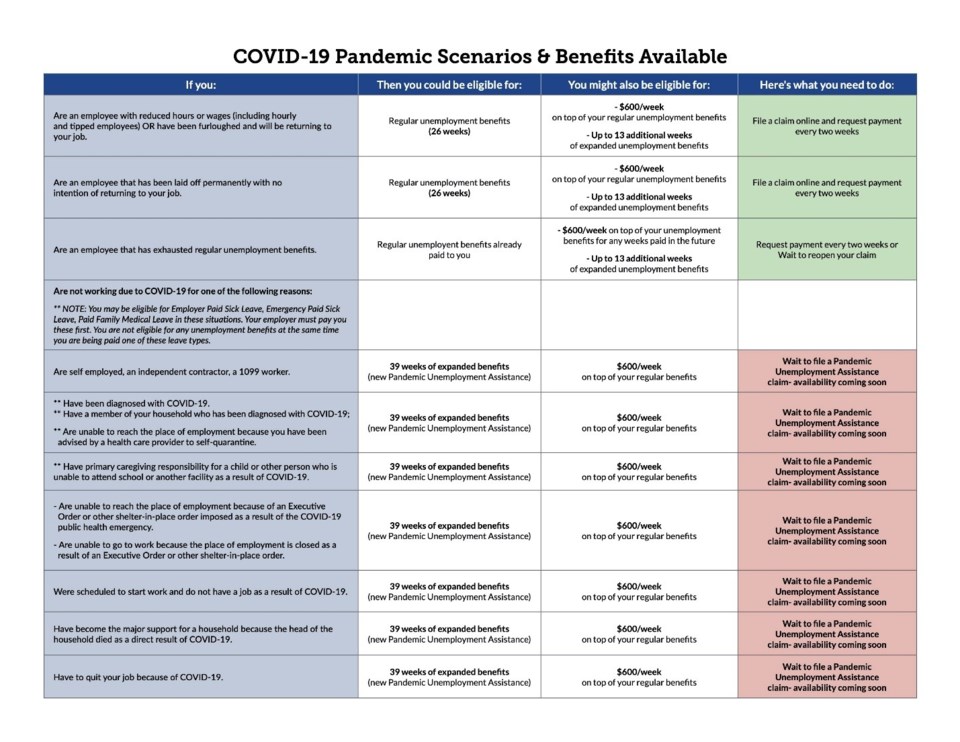

Though unemployment benefits will continue to be administered by the states, the Federal Department of Labor's explanation of extended benefits is an extremely useful reference.

Extensions to unemployment benefits are mandated by the CARES act, but distributed through the state unemployment system. Here are the main modifications to unemployment in CARES:

- Creates a Pandemic Unemployment Assistance program (PUA) that extends benefits to many workers who are not eligible under their state programs. Up to 39 weeks, or ending on December 31, 2020, whichever comes first.

- Adds a $600 federal benefit to state unemployment through July 31, 2020.

- Allows states to extend federally funded regular benefits by 13 weeks.

Because state-administered benefits are non-uniform and non-W2 employment arrangements are so diverse, workers who have lost jobs or had reduced hours, or work in the gig economy, are advised to simply apply for unemployment benefits. The PUA benefits are not available yet, as the state is seeking guidance on the new law. However, Figure 2 summarizes what you can expect. Recheck the link in the caption of Figure 2 to learn when PUA benefits are available. Be aware that the unemployment application system is overloaded. Keep trying.

Other State-Level Provisions

Governor Polis’s executive orders provide many short-term protections for persons finding themselves unexpectedly out of work. They have put the worse consequences of income loss on hold.

The most important order is D 2020 12. This order covers three fundamental necessities:

HOUSING:

- It limits evictions by directing state agencies to use all lawful means to avoid evicting tenants due to nonpayment of rents, and directs landlords and property owners to exempt tenants and mobile home owners from penalties for nonpayment or late payment of rents. It further directs Sheriffs, Mayors, and other local leaders to desist from conducting forcible evictions for any reason except those necessary to preserve public health and safety.

- It allocates 3 million dollars from the state Disaster Emergency Fund for rental assistance, to be administered by the Department of Local Affairs (DOLA) and tasks that agency to construct a fair means of distributing the funds to tenants earning less than 50% of the Area Median Income. It further directs DOLA to creatively seek means of funding additional rental assistance.

UTILITIES:

- Disconnection of service for all utilities is suspended for residents and small businesses.

- Utilities are directed to waive late payment fees, reconnect fees, and the like.

- The Public utility commission is directed to work with Public utilities (for Longmonters, XCEL) to augment payment assistance programs for lower income residents.

INCOME SUPPORT AND TAX ABATEMENTS:

- Expedited unemployment benefit claims.

- Waiting period before receiving benefits eliminated.

- Requirement for actively seeking work eliminated.

- State income tax returns deferred until July 31, synchronized with the revised Federal tax date.

- Extension in deadline for paying property tax.

Most provisions for deferred payments last for six months. Prohibitions on evictions and service disruptions were initially ordered for 30 days after March 20, but with the allowance that they could be extended for the duration of the emergency. Based on the evidence to date that the epidemic has not reached its peak, the orders seem certain to be extended.

County and Municipal Benefits

Boulder County offers a wide variety of personal and family services to assist you in coping with disruptions due to the COVID-19 emergency. Situational changes are being made so frequently, and the services are so numerous, that it is difficult to list them. The County maintains a frequently updated and comprehensive list of emergency services here. Services must be accessed on-line or by phone. County offices are closed to the public for the duration of the emergency. Currently the published end-date for the closure is April 30. A call center is open 8am to 8pm to answer questions at 720-776-0822.

The Longmont City Council has affirmed its commitment to adhere to and enforce the governor’s orders. The primary role of the city at this time is ensuring continuity of services, including water, power, and internet. In accordance with the governor’s orders, no suspensions of service will occur for the duration of the emergency. To ensure that as many children as possible have internet access at home while St. Vrain Valley schools are closed, NextLight is offering a special rate of $14.95/mo to income-qualified families, with the first two months free. As stated at the beginning of this article, most of the city’s regular housing support and mediation services remain available during the crisis. A summary of the city’s emergency resources can be found here.

.png;w=120;h=80;mode=crop)